Benefit from your credit card's interest free period

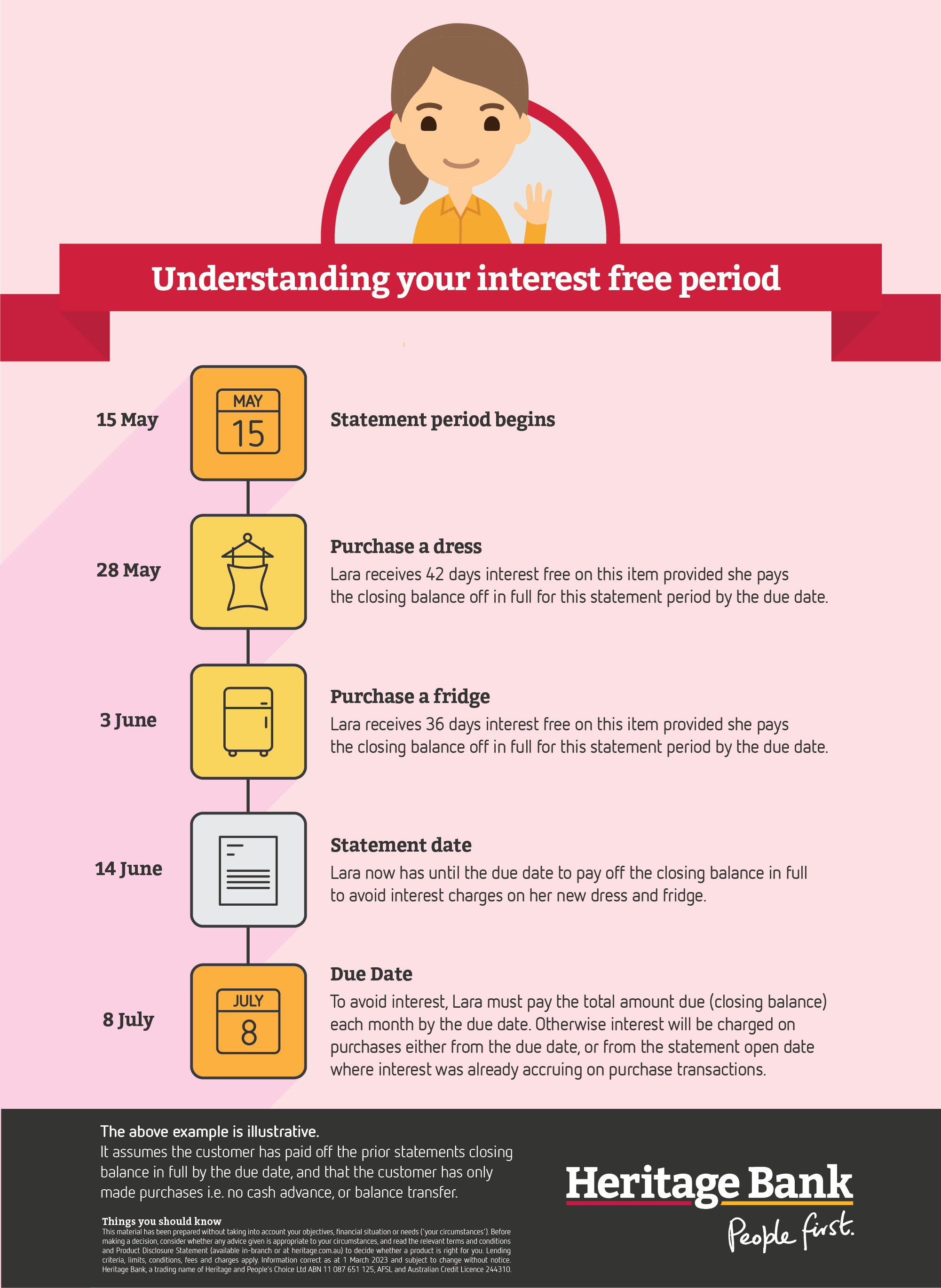

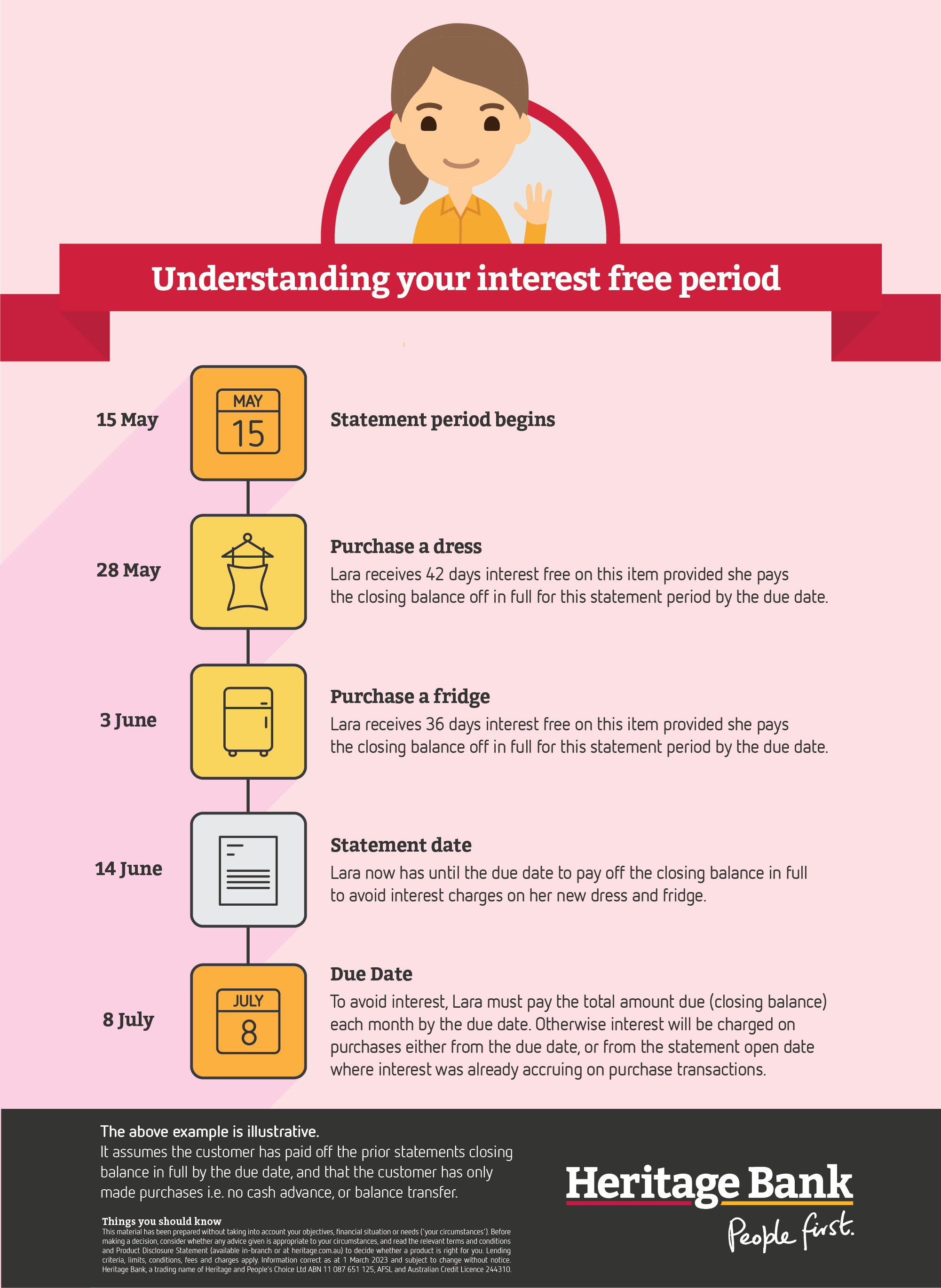

Using a credit card can be a great way to purchase the things you want while keeping that money in your savings account for longer. However, to make this work you’ll need to understand how interest free days work. We've put together some tips and a handy graphic to help you understand.

What is the interest free period?

The interest free period is the number of days between when you make the purchase and your next statement due date. It is the maximum amount of days you have between making a purchase and being charged interest (assuming you do not already have interest accruing balances left over from a prior statement period).

To enjoy the interest free period you will need to:

- Pay off your previous statement’s closing balance in full by the due date;

- Pay off your current statement’s closing balance off in full by the due date.

If you do not pay your previous statement's closing balance in full by the due date, you may continue to see interest charges appear on your statement. You can reset your interest free days at any time by paying off the full closing balance as shown on your most recent statement.

3 payment tips to help you benefit from the interest free period

- Pay off your closing balance in full by the due date each month

- Set up reminders to ensure you pay your closing balance in time, or

- Set up an automatic DuePay in Heritage Online using the Automatic Transfers to a Heritage Credit product selection.

Interest free days at Heritage

With Heritage, your credit card statement will be issued monthly on the same day that your credit card is approved. For example, if your credit card is approved on the 17 of November, then the date your credit card statement is issued will be the 17th of each month. Your credit card statement will contain the closing balance for all transactions made during the statement period (plus any previous balances you haven’t paid).

Generally, you then have 25 days from the end of the statement period to the payment due date. This means that if you are eligible for an interest free period the minimum number of interest free days you’ll have is 25 days. Our premium rewards credit card, classic rewards credit card and business credit card provide up to a maximum of 55 days interest free on purchases.

A credit card provides you with a great way to buy now and pay later. However, it’s important to take the time to read and understand how to get the most out of your interest free days before you start spending. If you are having trouble understanding interest free days on your Heritage Credit Card call us 24/7 on 13 14 22, visit your local branch or chat to us online.

Benefit from your credit card's interest free period