Refinance your home loan

Whether you're looking to save money on your interest rate, reduce your repayments or borrow more for renovations, home loan refinance can be easier than you think. If you'd like to refinance your home loan to Heritage, we're here to help.

About this Rate

Why refinance your home loan to Heritage?

Flexible repayment options

Free unlimited extra repayments and online redraw of payments in advance

FASTRefi®

If eligible, FASTRefi® allows your refinance to be processed much faster than a traditional refinance, often within days of returning signed loan documents.^

People first service

People first service and commitment to our customer-owned values

How does a home loan refinance work?

What is FASTRefi®?^

In a traditional refinance you'd be required to arrange settlement with your current lender which can take several weeks and plenty of paperwork. FASTRefi® enables your existing loan to be paid out prior to settlement so your refinance to Heritage is streamlined.^ Using this service will cost you no more than a standard refinance and provide you certainty of when your new loan will be available.

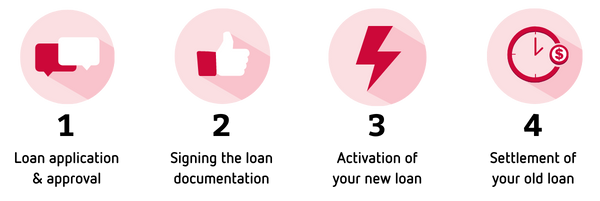

The FASTRefi® Process

If you'd like to use FASTRefi®, simply complete your home loan application as normal. Our Lending Specialists will help you confirm whether your loan is eligible for FASTRefi®, and guide you through the loan application and assessment process.

Would you like to learn more?

- View our FASTRefi® Brochure

- Visit firsttitle.com.au/fastrefi

- Talking to a Heritage Lending Specialist by calling 13 14 22 or enquire online

Home loan application checklist

How much money will refinancing save you?

Refinancing your home loan can be a great opportunity to save some money and pay off your loan sooner. Use our refinancing calculator to find out how much you could save by refinancing your home loan to Heritage.

Compare all our home loans

If you'd like to compare the features and benefits of all the home loans we have on offer, visit compare all home loans.

Help with switching to Heritage

People first. Always.

We've been committed to Australian communities since 1875. In a world where so much has changed, our mission to put people before profits, never has. Learn more