Are term deposits worth it?

Term deposits are a popular choice for those looking to earn interest on their savings, but many people wonder if term deposits are worth it.

Term deposits are a safe and secure way to earn a guaranteed return on your money, without the risks associated with other types of investments. By locking your money away for a set amount of time, you can often earn a higher interest rate than a regular savings account, and the temptation to access your money is lowered.

How much interest could you earn with a term deposit?

Let’s calculate an example based on the average Australian's saving figure, using our Heritage Bank Term Deposit Calculator.

According to Finder in 2023, the average Australian saved about $705 a month. Over a year this equals around $8,460 in savings.

Let’s say you deposited that $8,460 annual savings into a term deposit, earning 3.5% per annum for 1 year and chose to have the interest paid at the end of the year to your account.

The interest earned would be around $296.

While this may not seem like a lot, remember that term deposits are low-risk investments and it’s $296 you didn’t have at the start of the year.

What are my other options?

It’s important to seek professional financial advice if you are unsure.

If you want flexible access to your savings every day, you could consider a high interest savings account that allows you deposit regularly and withdraw your money at any time.

Or let’s say you have a mortgage or personal loan with the flexibility to make extra repayments (payments in advance). This would be another place to consider for your savings to reduce the interest you are charged. Keep in mind, the interest saved is not guaranteed and will depend on interest rate changes and if you redraw money off your loan. You may also need to check if any fees will apply for paying your loan out early.

Use our home loan repayment calculator to see how a regular extra repayment or lump sum payment could help you save interest and time on your own mortgage.

Are they really worth it?

Term deposits are worth considering if you want to earn a guaranteed return on your savings. They can be a great option for those looking to save for a specific goal, such as a holiday or a down payment on a home.

Although the interest earned may not be as high as other types of investments, the low risk and security they offer make them a great option for those looking for a safe place to park their money. If you are looking for a way to grow your savings, opening a term deposit account is a great first step.

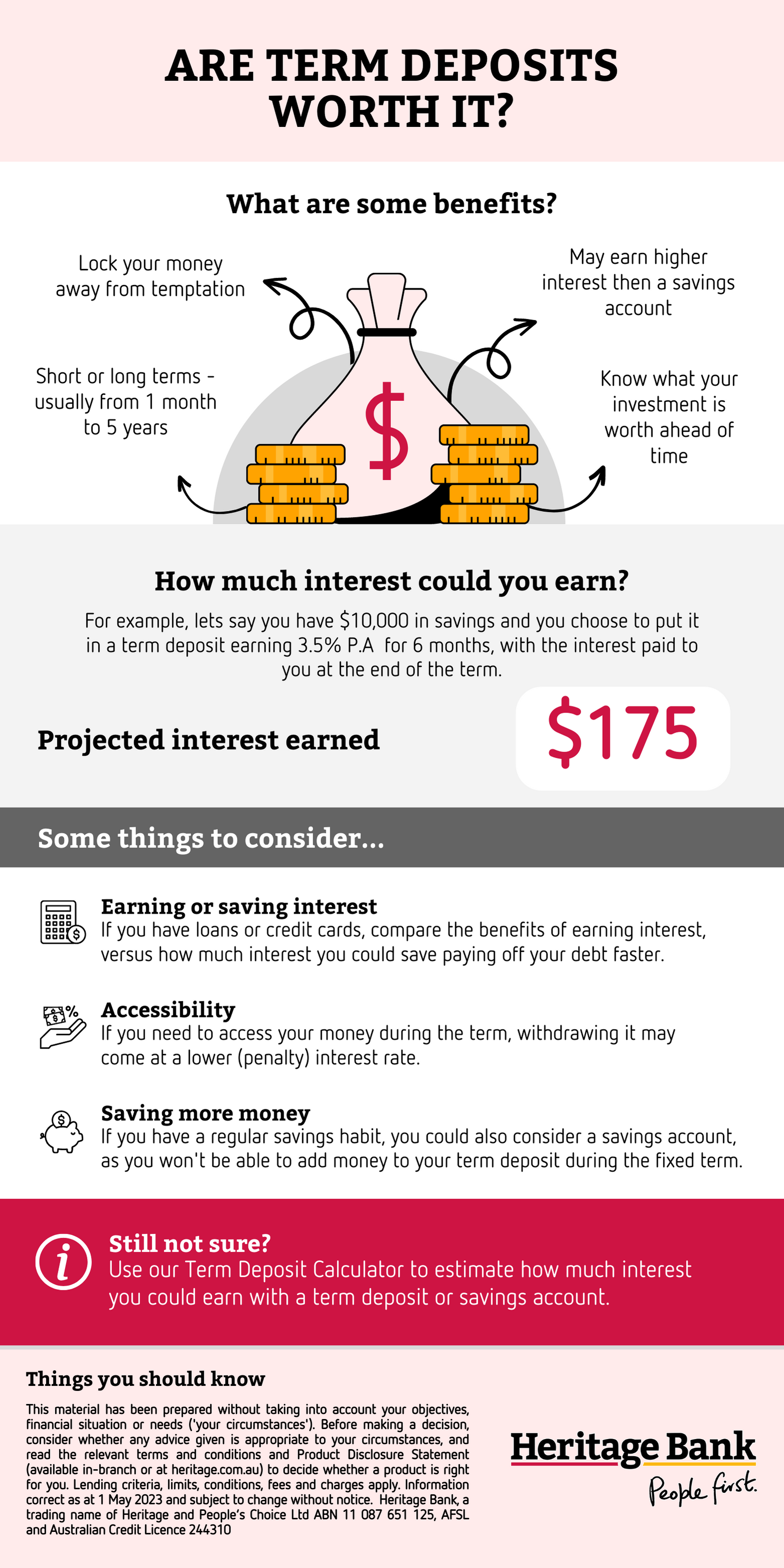

Learn more with this helpful infographic.

Are term deposits worth it infographic

| Featured Term Deposit | |

|

4 month term deposit for $1,000 or more

|

|

|

|

|